Decoding Cashflow: A Comprehensive Guide

Cash flow is the lifeblood of your business – it’s what keeps the lights on, the team motivated, and the innovation flowing. But don’t worry, I’ve got your back! In this blog post, we’re diving deep into the world of cash flow, uncovering its mysteries, and unleashing its power for your startup’s growth!

- Impact Hub Nairobi

- Grace M

Defining Cash Flow: What It Is and Why It Matters

Cash flow refers to the net amount of cash and cash equivalents moving into and out of a business. It encompasses all the money that a business brings in as revenue and all the money it spends on operating expenses, investments, and other financial activities.

Understanding cash flow is crucial because it directly impacts a business’s ability to sustain operations, invest in growth, and meet financial obligations. Positive cash flow indicates that a company is generating enough revenue to cover its expenses, while negative cash flow can signal financial instability and potential insolvency.

Cash flow is more than just numbers on a spreadsheet. It's the pulse of your business

John Doe

Types of Cashflow

Cash Flows from Operations (CFO): A Dynamic Indicator of Business Health

Cash flow from operations is a key performance indicator that can reveal how well or poorly a company is doing financially. This term refers to the net amount of cash that has been generated or used up by a particular firm in the course of its normal business activities. This figure is what shows if a company has enough money for day-to-day operations, capabilities for growth and expansion, and ability to meet its obligations.

The CFO is measured as revenue collected minus direct costs incurred in buying or making products. A positive CFO indicates a healthy financial position while failure to achieve this may be associated with going concern problems.

Cash Flows from Investing (CFI): Fueling Growth and Innovation

The investments and spending patterns are revealed through this item on the financial statement thus indicating how the organization uses its assets. These include purchase and sale of long-term assets like land, building, plant and machinery etc., investment made in shares, debentures–normally short-term securities having maturity period under one year –of other companies excluding bank deposits with maturity period exceeding three months only.

Negative CFI suggests substantial spending on initiatives aimed at growing, R&D or acquisitions which means good value may lie ahead over time. However too much negative CFI could imply poor capital management by an organization.

Cash Flows From Financing (CFF): A Window into Financial Strength.

Through Cash Flow from Financing (CFF), one can have a sneak peak into the capital structure of the company and its capacity to raise funds. It represents cash flows associated with financing activities such as issuance of debts, equity or dividend payments made by the company.

Positive CFF indicates that a firm can attract capital whereas negative CFF may imply reliance on debts or need for reducing dividends. Therefore, examining CFF is important for comprehending financial flexibility of an organization and ability to meet future growth prospects.

Analyzing the Components of Cash Flow

Cash flow is typically divided into three main components: operating activities, investing activities, and financing activities. Operating activities include the core business operations, such as sales and expenses. Investing activities cover the acquisition and disposal of long-term assets like property and equipment. Financing activities involve transactions related to equity and debt, such as issuing stocks or taking out loans.

By analyzing these components, businesses can gain insights into their financial health and identify areas that may require attention. For instance, consistently negative cash flow from operating activities might indicate underlying issues with the business model or cost structure.

The Cash Flow Cycle: From Inflows to Outflows

Picture this: money coming in from sales, investments, or any other source is like fuel for your startup’s engine. But just like a powerful engine, your business also has expenses – salaries, rent, supplies, and more. The cash flow cycle tracks the draw back and flow of money, ensuring there’s always enough to keep your business roaring forward.

Strategies to Optimize Your Cash Flow

Improving cash flow requires strategic planning and effective management. One common strategy is to accelerate receivables by offering early payment discounts to customers or implementing stricter credit policies.

Another approach is to manage payables by negotiating longer payment terms with suppliers or taking advantage of early payment discounts.

Businesses can also optimize cash flow by controlling operating expenses, such as reducing overhead costs or outsourcing non-core activities. Additionally, maintaining a cash reserve can provide a buffer against unexpected financial challenges.

Understanding the Impact of Cash Flow on Business Sustainability

Cash flow is a critical factor in determining a business’s sustainability. Consistent positive cash flow allows a company to invest in growth opportunities, repay debts, and weather economic downturns. Conversely, poor cash flow management can lead to financial distress, hinder growth, and even result in bankruptcy.

By focusing on cash flow management, businesses can ensure long-term stability and success. This involves regularly monitoring cash flow, analyzing financial statements, and implementing strategies to improve liquidity and financial performance.

The Bottom Line

Understanding cash flow isn’t just about numbers – it’s about empowerment. It’s about harnessing the financial side of your business to drive unstoppable growth and innovation.

By forecasting, monitoring, and adjusting your cash flow, you can steer clear of financial storms and keep your momentum strong. With the right strategy, you can turn potential pitfalls into opportunities for growth

Unleash your impact potential today

Join our Community for the latest news, resources, and inspiring stories of entrepreneurial impact. Sign up now and ignite your journey towards making a difference.

You also might like

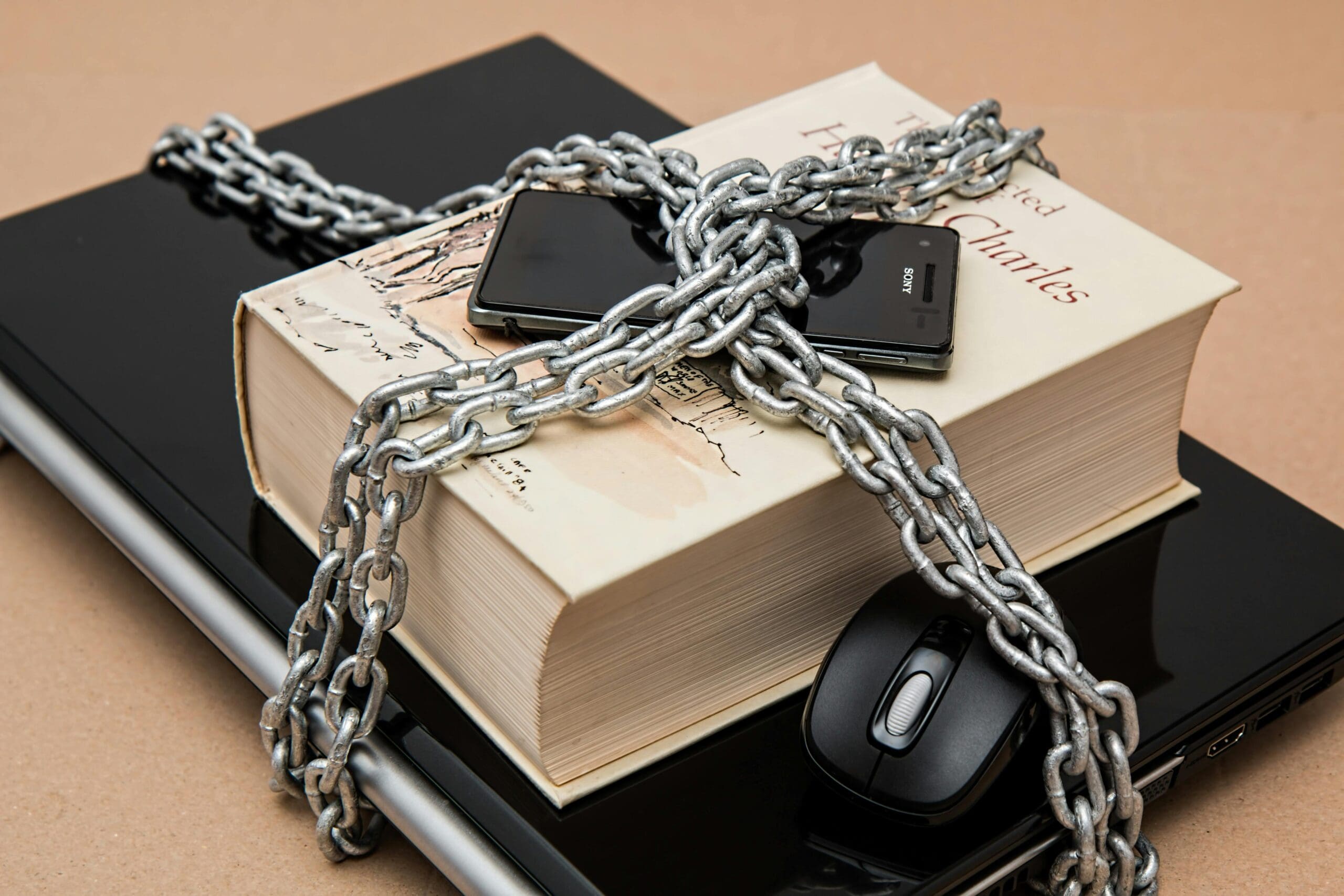

Are You Missing Critical IP Protections for Your Startup?

Are You Missing Critical IP Protections for Your Startup?

Footprints of Change: A Recap of the Climate Summit

Footprints of Change: A Recap of the Climate Summit